Navigating the ins and outs of interest can get tricky, but Nick makes it easier, explaining the dance between interest receivable and payable. He demonstrates how to record interest that has been earned but not yet received, as well as the steps to take when that interest finally hits the bank account. It’s a clear, real-world scenario that demystifies the financial statements involved and the impact of these entries over time. This is to avoid the understatement of total expenses on the income statement as well as the understatement of total liabilities on the balance sheet.

Accounting for Interest Payable: Definition, Journal Entries, Example, and More

Interest expense is the cost of using monitory facilities or consuming financial benefits for some time that offer by a financial institution or similar institution. Interest payable is a critical component of financial management for businesses. It is the amount of interest that a company owes to its creditors for a period of time.

Journal Entries Playlist

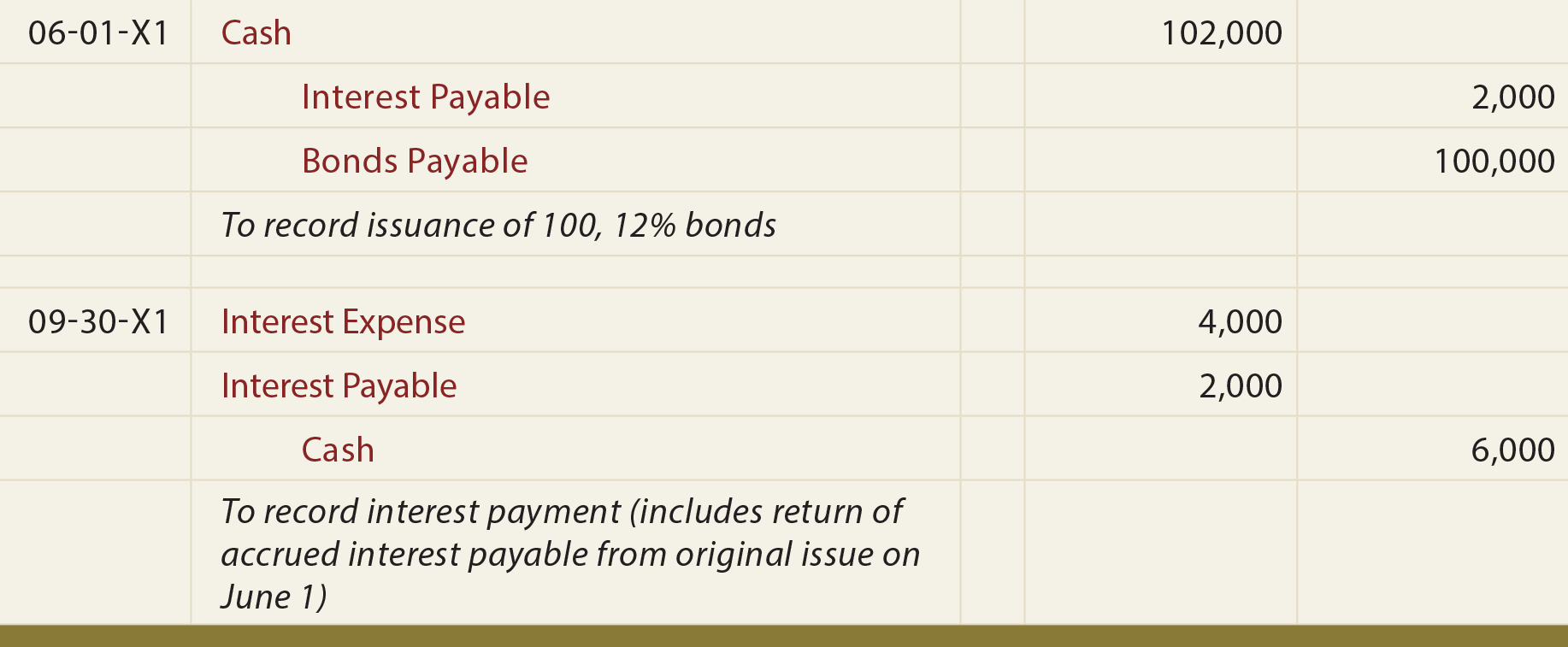

Later, when we make the cash payment for the interest, we can make another journal entry with the debit of the interest payable account and credit of the cash account to clear this liability. This journal entry of the accrued interest expense is made to recognize and record the expense that has already the best tax software for us expats occurred for the period. At the same time, it is also made to record the liability that exists for we have not made the cash payment yet. In that case, it shows that a corporation is defaulting on its debt commitments, and this amount may be a critical aspect of financial statement analysis.

How to Record Accrued Interest in Your Books

The reason is that each day that the company owes money it is incurring interest expense and an obligation to pay the interest. Unless the interest is paid up to date, the company will always owe some interest to the lender. A business owes $1,000,000 to a lender at a 6% interest rate, and pays interest to the lender every quarter. After one month, the company accrues interest expense of $5,000, which is a debit to the interest expense account and a credit to the interest payable account. After the second month, the company records the same entry, bringing the interest payable account balance to $10,000.

Best Practices for Recording Journal Entries

The journal entry is used to record the amount of interest paid to the creditors. It also serves as a reminder to the company of the amount of debt that needs to be paid. The journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred. This journal entry will eliminate the $3,000 of interest payable that the company has recorded on Dec 31, 2020.

How To Calculate?

At the same time, it is to record the expense incurred during the current period. This journal entry will eliminate the $50,000 note payable that we have recorded on July 1, 2021, as well as the $2,500 interest payable that we have recognized on December 31, 2021. Likewise, this journal entry will decrease both total assets and total liabilities on the balance sheet by $52,500 as of January 1, 2022. This account is a non-operating or “other” expense for the cost of borrowed money or other credit. Unearned Revenues is a liability account that reports the amounts received by a company but have not yet been earned by the company.

- And since usually we don’t pay for interest expenses right away, the other account part of the journal entry is interest payable, which is a liability account representing the debt.

- Interest expense usually incurred during the period but not recorded in the account during the period.

- In that case, it shows that a corporation is defaulting on its debt commitments, and this amount may be a critical aspect of financial statement analysis.

- Cash accounting recognizes revenue and expenses when cash is actually received or paid.

Accrual basis accounting is good for businesses with significant credit sales or deferred revenue. Most public companies and many private companies must use accrual basis accounting reporting purposes. Prepaid expenses are payments made in advance for an expense that will be delivered in the future. Although the word expense is in their title, they are recorded as assets on the balance sheet.

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The interest for 2016 has been accrued and added to the Note Payable balance.